By the ISCT Business Development & Finance Committee

With investment activity fluctuating across the cell and gene therapy sector, access to timely financing and M&A insights is essential for organizations to stay informed and ahead of the curve. The ISCT Business Development & Finance Committee is addressing this need by analyzing investment data to provide expert perspectives on recent market dynamics. This article launches a series in which committee members highlight emerging trends, interpret recent deals, and offer forward-looking guidance to support strategic decision-making in the CGT sector.

This edition draws on deal data compiled between February and September 2025. The analysis includes disclosed transactions above $50M focusing on RNA, AAV, CAR T, Stem cells, Novel manufacturing, Epigenetic & TCR T across North America and Europe.

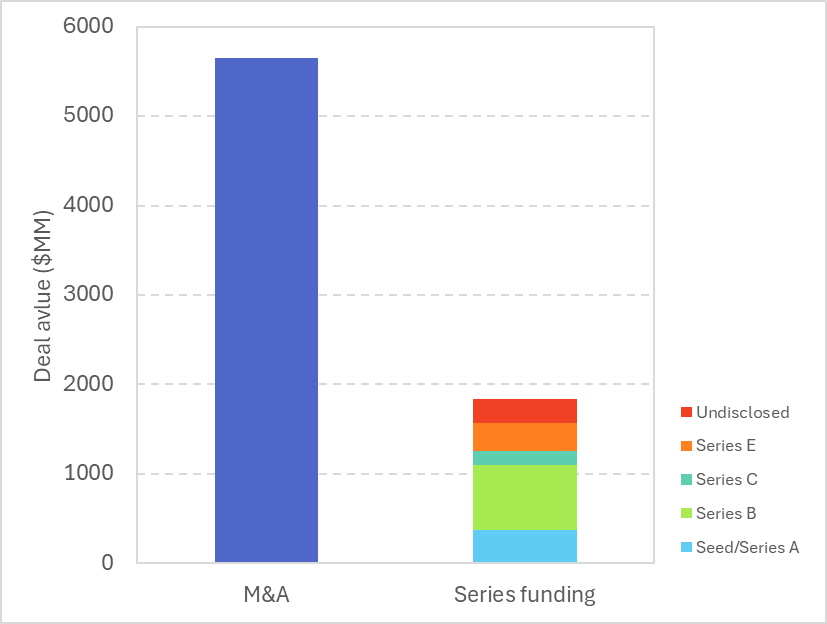

The cell and gene therapy (CGT) sector continues to attract significant investment, with recent deal activity highlighting a strong focus on CAR T cell technologies and RNA-based therapies (comprised of various kinds of RNA modalities). According to the latest data from Q2-Q3 (>$50 MM deal value), total disclosed deals across six major therapeutic platforms reached approximately $7.5 billion, underscoring investor confidence in advanced modalities (Figure 1). These M&A deals are driven by large biopharma such as AbbVie, whose acquisition of Capstan Therapeutics accounted for over a quarter of total deal flow in the CGT space in the past two quarters. They are clearly attracted to the potential of buying platform access and becoming leaders in emerging CGT modalities. Meanwhile, corporate VCs continue to lead and participate in equity rounds for various modalities, including AAVs, CAR T, RNA, and more.

Figure 1. Overview of CGT deal flows in Q2-3 2025

Figure 1. Overview of CGT deal flows in Q2-3 2025

Mergers & Acquisitions within the CGT space

In vivo CAR T: the emerging superstar

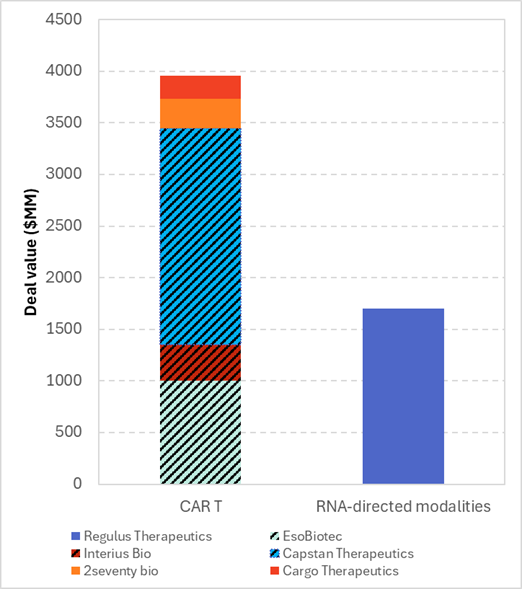

Six major M&A deals totaling $5.65 billion were identified in the past two quarters, revealing clear strategic patterns among leading pharmaceutical investors. And by far the most significant driver, CAR T cell therapies attracted nearly $4 billion, thus continuing to garner investor interest. However, the real story lies within the in vivo CAR T subsegment, which captured $3.45 billion, or about 87% of M&A CAR T investment (Figure 2). Unlike ex vivo CAR T cell therapies, which require the collection of patient T cells and the generation of patient-specific CAR T cells in the lab, in vivo therapies involve injecting a CAR gene delivery vector directly into patients. The largest in vivo CAR T deal was AbbVie’s $2.1 billion cash acquisition of Capstan Therapeutics. Capstan currently has a first-in-class in vivo anti-CD19 CAR T therapy in Phase I for the treatment of autoimmune diseases, powered by their proprietary tLNP platform technology, which AbbVie also acquired through this deal. Similarly, with the acquisition of EsoBiotech, AstraZeneca acquired its proprietary ENaBL platform (an immune-shielded lentiviral vector) for generating in vivo CAR T cells.

Notably, investors of in vivo CAR T have not been limited to large biopharma like Gilead Sciences, which acquired Interius Bio for $350 MM [2]. Venture capital firms have also shown interest, as seen in the funding round for Stylus Medicine, which included RA Capital Management and Koshla Ventures among others [3]. This reflects a strategic shift toward in vivo engineering approaches that aim to simplify manufacturing and reduce costs compared to traditional ex vivo CAR T therapies. Despite this interest, the clinical efficacy and safety of in vivo CAR T therapies remain to be determined. Meanwhile, traditional CAR T deals continue to represent a large share of CGT deals, as they have in previous years, with 2seventy bio and Dispatch Bio raising $286 MM and $200 MM each, respectively [4,5].

RNA-based technologies also raised significant sums; however, this was driven by just a single mega-deal: Regulus Therapeutics, which was acquired by Novartis for $1.7 billion [6]. Regulus Tx is a clinical-stage company that develops microRNA therapies to treat a range of diseases, with a key drug being farabursen, an oligonucleotide targeting the microRNA miR-17 for the treatment of kidney disease.

Figure 2. Contribution of M&A deals. The overlayed pattern represents in vivo CAR T companies.

Figure 2. Contribution of M&A deals. The overlayed pattern represents in vivo CAR T companies.

M&A summary

The only modalities involved in large transaction deals were CAR T cell therapies and RNA therapies, with biopharma looking to acquire and secure proprietary platform technology platforms that can generate multiple assets over time. This reduces long-term R&D risk and accelerates pipeline diversification. The investments into in vivo CAR T platforms signal industry interest towards in vivo engineering approaches to streamline manufacturing and treatment, but also reflect a new, un-captured frontier as the traditional ex vivo CAR T space is already heavily commercialized.

Series funding within the CGT space

Consolidation in AAV gene therapies

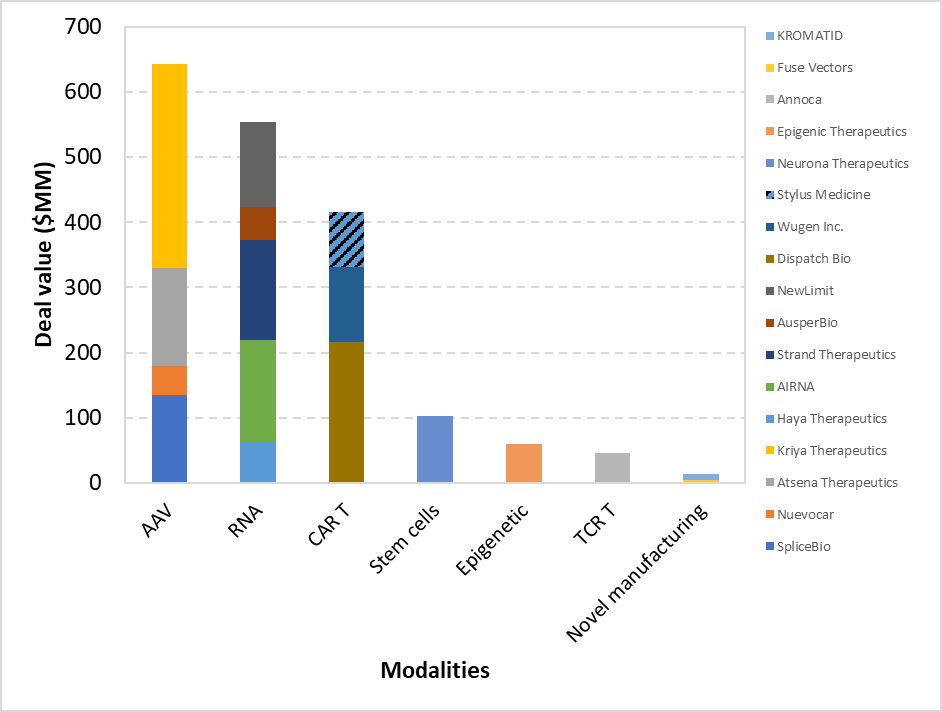

VC mainly drove series funding and showed greater diversity in modalities. Unlike M&A, venture funding was spread across AAV, RNA, CAR T, and more (Figure 3). This reflects VCs’ appetite for emerging science, and they are attracted to specific asset value. AAV gene therapy emerged as the most significant driver, followed by CAR T. AAV gene therapy companies raised $643 MM (Figure 3). This was primarily driven by a $313 MM investment in Kriya Therapeutics by an as-yet-undisclosed investor. Kriya has several pipelines with its ophthalmology and neurology drugs currently in trials [7]. Interestingly, all four AAV companies on the list are targeting smaller, non-systemic indications—three in retinal diseases and one in cardiac. This trend may reflect investor caution towards systemic conditions like haemophilia, which involve significantly higher manufacturing costs and dosing complexity. In contrast, retinal disorders typically require lower doses, offering a more favourable safety profile and reduced cost burden.

A different picture of CAR T cell therapies

CAR T cell modality raised over $400 MM across three startups, but unlike with M&A, the majority of CAR T fundraising was for ex vivo modalities. Dispatch Bio accounted for over half of the deal flow. Their therapeutic strategy involves viral vector delivery of a novel proprietary antigen, “Flare”, to cancer cells, followed specifically by infusion of ex vivo CAR T cells engineered to target this antigen. An attractive factor of this technology is its potential to target multiple tumour types. Similarly, Stylus Medicine’s in vivo approach, incorporating lipid nanoparticles and recombinase, also enables targeting of various diseases. Traditional CAR T cell therapies have been limited by engineered CARs to very specific disease indications, thereby reducing their applicability. Investors are likely keen to support broad-spectrum CGT treatments due to increased commercial viability. Lastly, Wugen Inc.'s success continues to demonstrate investor confidence in allogeneic solutions, which enable off-the-shelf therapies that simplify manufacturing.

All three CAR T companies have very diverse platforms, which indicates that bold and innovative ideas to treat a broad population base are highly sought after by CAR T investors.

Others

There has been broad interest in RNA-directed modalities with notable RNA players including AIRNA ($155M) and Strand Therapeutics ($153M). In fact, the most frequent equity deals were for RNA-directed modalities companies with therapy-agnostic technologies (Figure 3). Indeed, Strand Therapeutics’ technology and platform enable targeting across various modalities (and, in fact, two drugs in its pipeline are CAR T cell therapies), while AIRNA offers a general-purpose RNA editing system.

Transient and non-permanent gene editing has also received attention. While AIRNA’s RNA editing is non-permanent by nature, Epigenic Therapeutics raised $60 MM to support its ongoing clinical development of gene-modulation therapies utilising epigenome regulation. And as with the previously mentioned examples, its in vivo delivery platform can also be used for various diseases and organs.

Despite the threshold deal value of $50 MM, given the significant impact of manufacturing on the success of cell and gene therapies, this article also highlights the growing presence and investor interest in novel manufacturing tools. Fuse Vector recently raised pre-seed funding for its novel cell-free production of AAV vectors, and KROMATID raised $8 MM for its advanced analytics platform that can aid the development of CGT therapies.

Figure 3. Series financing deals based on modalities.

Conclusion

The cell and gene therapy (CGT) sector is undergoing a dynamic transformation, with in vivo CAR T-cell therapies and RNA-based platforms emerging as frontrunners in attracting investor capital. The sheer scale of investment reflects not only confidence in the science but also a strategic race among biopharma giants to secure platform dominance in next-generation modalities. Another running theme is the concept of “universality” – companies need their technology to be multi-faceted, whether it is a universal genome-modulation platform that can be utilised across various strategies, as with AIRNA and Epigenic Tx, or universal off-the-shelf products, as with Wugen and Neurona. Additionally, many of these companies (at least 10 confirmed, but likely more) incorporate lipid nanoparticle systems into their pipelines, which can be safer and cheaper than viral vector delivery methods.

Despite some recent setbacks, CGT companies continue to raise significant sums, especially given that this report has not included undisclosed deals such as the acquisition of Alpha Anomeric by AlphaRose Therapeutics [8]. Various VC firms continue to scout for promising companies, and they have specific preferences for modalities (Table 1, 2; Figure 1). The insights herein will hopefully aid founders and investors alike in building future CGT ideas.

Table 1. List of all companies and respective modalities that raised over $50 MM in the Q2-3 of 2025. Note that “Novel manufacturing” startups are included despite the threshold.

Table 2. List of identified investors and acquirers per modality.

#CommunityFeature#IndustryMemberNews